Sorairo Asset Consulting

“Bringing satisfaction to your life and money.”

We solve your concerns about asset formation and retirement planning with professional insight.

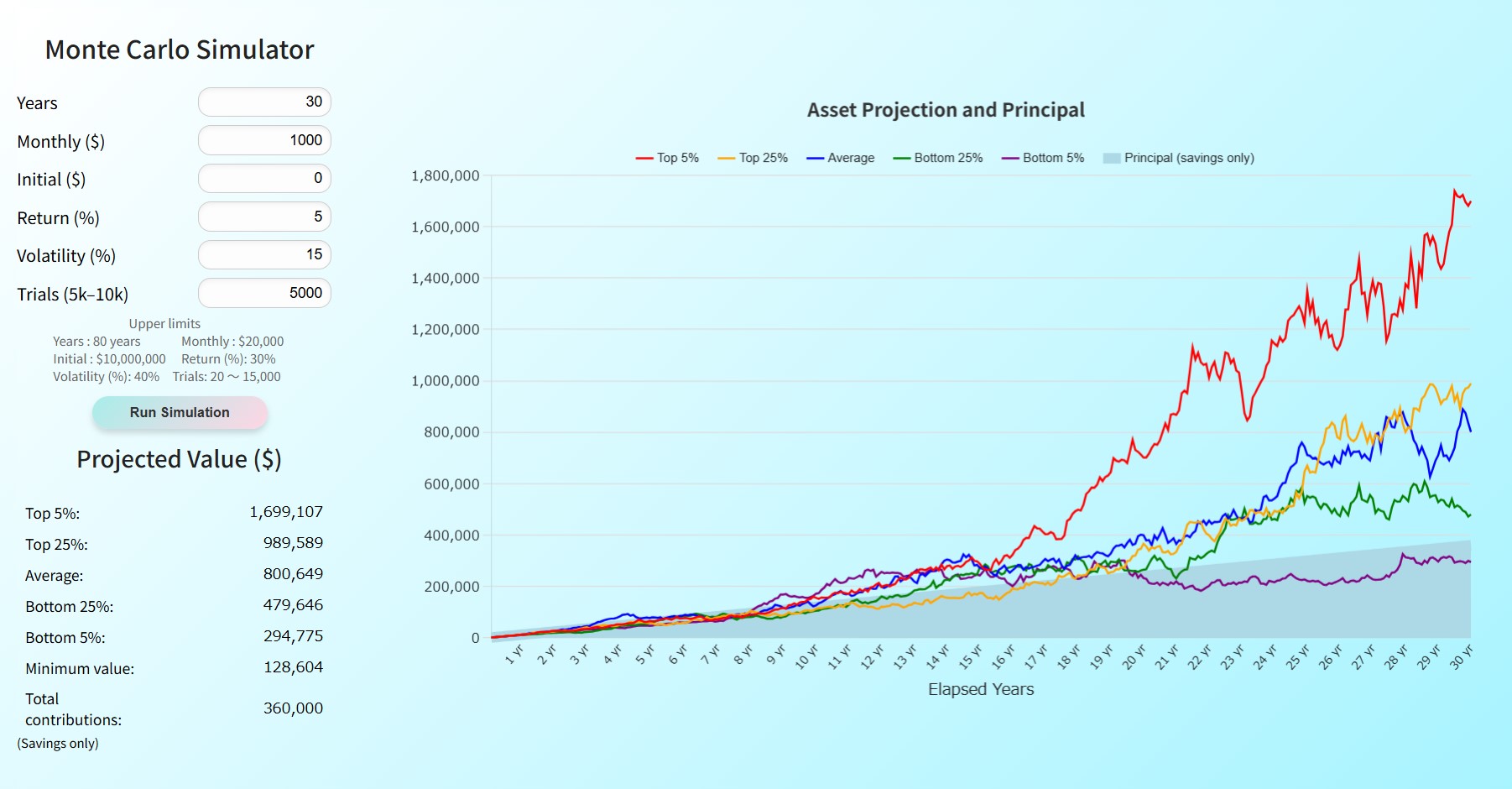

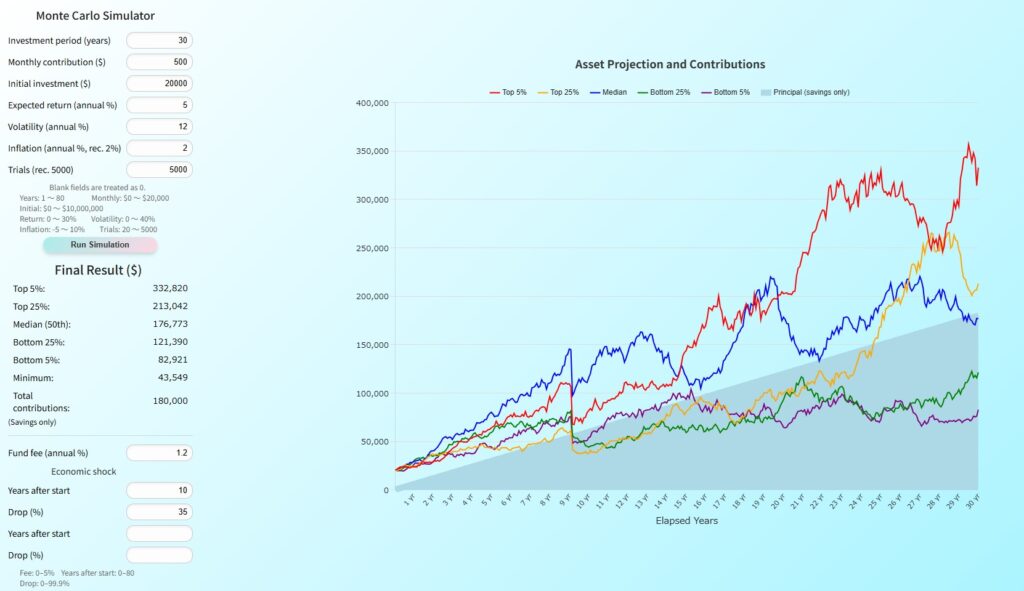

Learn and Use It Independently — Monte Carlo Simulator

A visualization tool called “Mirai Canal” lets you see how much your asset management may fluctuate in the future.

Demonstration Video

Do you have concerns like these?

- You want to start investing, but you feel uneasy.

- You can’t imagine how much pension you’ll need in retirement.

- You’re wondering if you can increase your assets even a little through investment management.

- You’re thinking about your child’s education fund and wondering if it’s better to start some investment early.

→ “All of these can be solved with this simulation tool.”

Financial‐planning specialists focused on asset management

Would you like to visualize your asset formation in terms of probabilities?

Using Monte Carlo simulation we forecast future asset trends numerically.

Get solid support for developing and validating your investment strategy.

- Designed by a First-Class Certified Skilled Financial Planner (National Qualification, Japan) and a Certified Member Analyst (CMA) of the Securities Analysts Association of Japan

- You can test outcomes for retirement funds, education funds, housing preparation funds, etc.

- Use Monte Carlo simulation to visualize the risks of long-term, tax-advantaged investing strategies.

- Just input conditions such as contribution period, contribution amount, initial investment, etc., and you can easily simulate.

- Understand the trend of asset management… since you know in advance how it might evolve, you’ll gain peace of mind.

You can simulate how much your mutual funds could increase—or decrease—in the future.

Just holding mutual funds for education, a home or retirement without a plan doesn’t give you a clear goal for asset management.

This simulation tool lets you grasp in advance the risk when investment succeeds or falls below expectations.

Included files

- User guide (PDF)

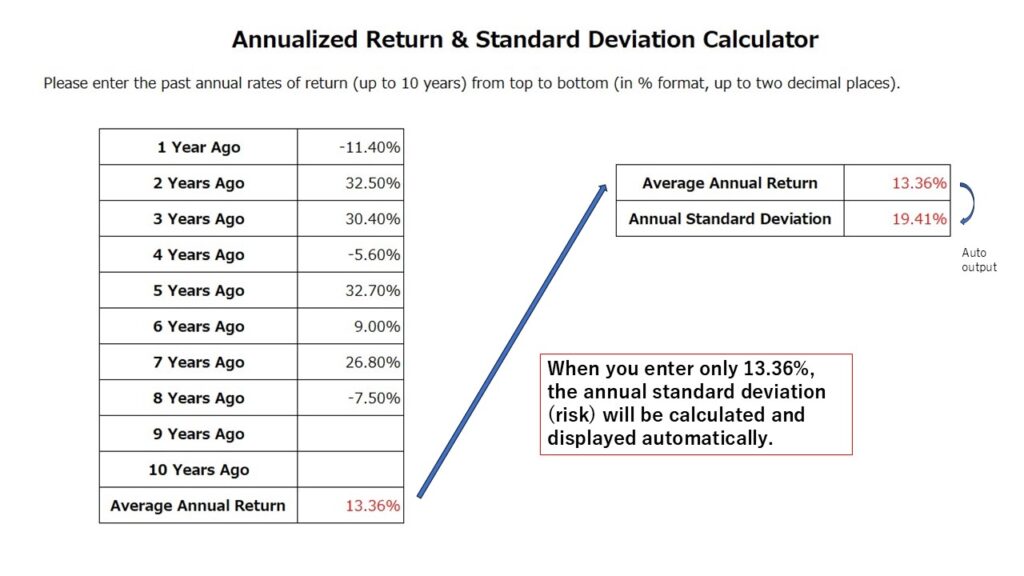

- Average return & risk (standard deviation) calculation tool (Excel)

What you can do with this tool

- Get an idea of how much you’ll need for retirement funds.

- See how varying the contribution amount and risk level affects the result.

- Make it easier to plan your investment strategy for long-term, tax-advantaged accounts.

- Understand not just the “average” but also what happens when things go well or when they go downward.

Recommended for people who…

- Are in their 30s to 70s and feel uneasy about their future assets.

- Are interested in investing but feel unsure.

- You may have started investing without a clear plan and now want to reassess your strategy.

- Feel hesitant to consult with a financial planner, but want grounded decision-making material.

How to use it — simple

- No personal information registration required; anyone can use it anytime.

- Enter the following in the settings sheet: monthly contribution, number of years, initial investment, average annual return, and risk.

- Just click the “Run Simulation” button.

- Results are automatically graphed and the final asset amount is displayed.