— What Monte Carlo Simulation Reveals About Reality —

When people start talking about retirement planning, one of the first things most consider is average return: the idea that if investments earn, say, 3%, 4%, or 5% annually, retirement savings will be safe and sufficient.

However, planning retirement finances based solely on average returns is dangerous. What really matters in retirement planning is not an “average future,” but how investment outcomes can unfold in unfavorable sequences and timing that actually occur in real markets. This article explains why average-return thinking can mislead retirees and how Monte Carlo simulation helps visualize the risks hidden behind simple averages.

- Average Return Is Not a True Representative of Future Outcomes

- Sequence of Returns Risk Is Critical in Retirement

- “It Will Follow the Average” Mentally Misleads People

- What Monte Carlo Simulation Shows

- What Retirement Planning Needs Most: Margin

- Average Return Is a Reference, Not the Answer

- Rethinking Retirement Planning

Average Return Is Not a True Representative of Future Outcomes

An average return is simply a long-term statistical measure—an arithmetic mean of past results. It implicitly assumes:

- Annual returns are evenly distributed,

- Good and bad years balance out,

- Asset changes move smoothly over time.

In reality, financial markets do not behave like this. Some years see strong gains, others see sharp declines—and no one knows in which order they will occur. The average return flattens these ups and downs and does not reflect the actual journey investors might experience.

Sequence of Returns Risk Is Critical in Retirement

One major issue that average return assumptions fail to capture is sequence of returns risk.

Suppose two scenarios:

- Both have the same average return,

- Both last for the same duration.

But in one scenario, a market crash happens just after retirement; in another, markets rise initially and fall later. Even with identical averages, the final financial outcome can be dramatically different.

This matter is especially significant during retirement when you are withdrawing funds as well as investing. If a large drop happens early in retirement:

- You may have to sell assets at depressed prices,

- Principal shrinks faster,

- Recovery may come too late before funds are depleted.

Average return does not warn retirees about this risk.

“It Will Follow the Average” Mentally Misleads People

Plans based solely on average returns can also be psychologically fragile. When real returns deviate from expectations, people often feel:

- “This isn’t what I planned for,”

- “Is this safe?”

- “Should I change to a safer strategy?”

In retirement, income sources are limited and time to recover losses is short. This mismatch between expectations and reality can trigger anxiety and impulsive decisions.

What Monte Carlo Simulation Shows

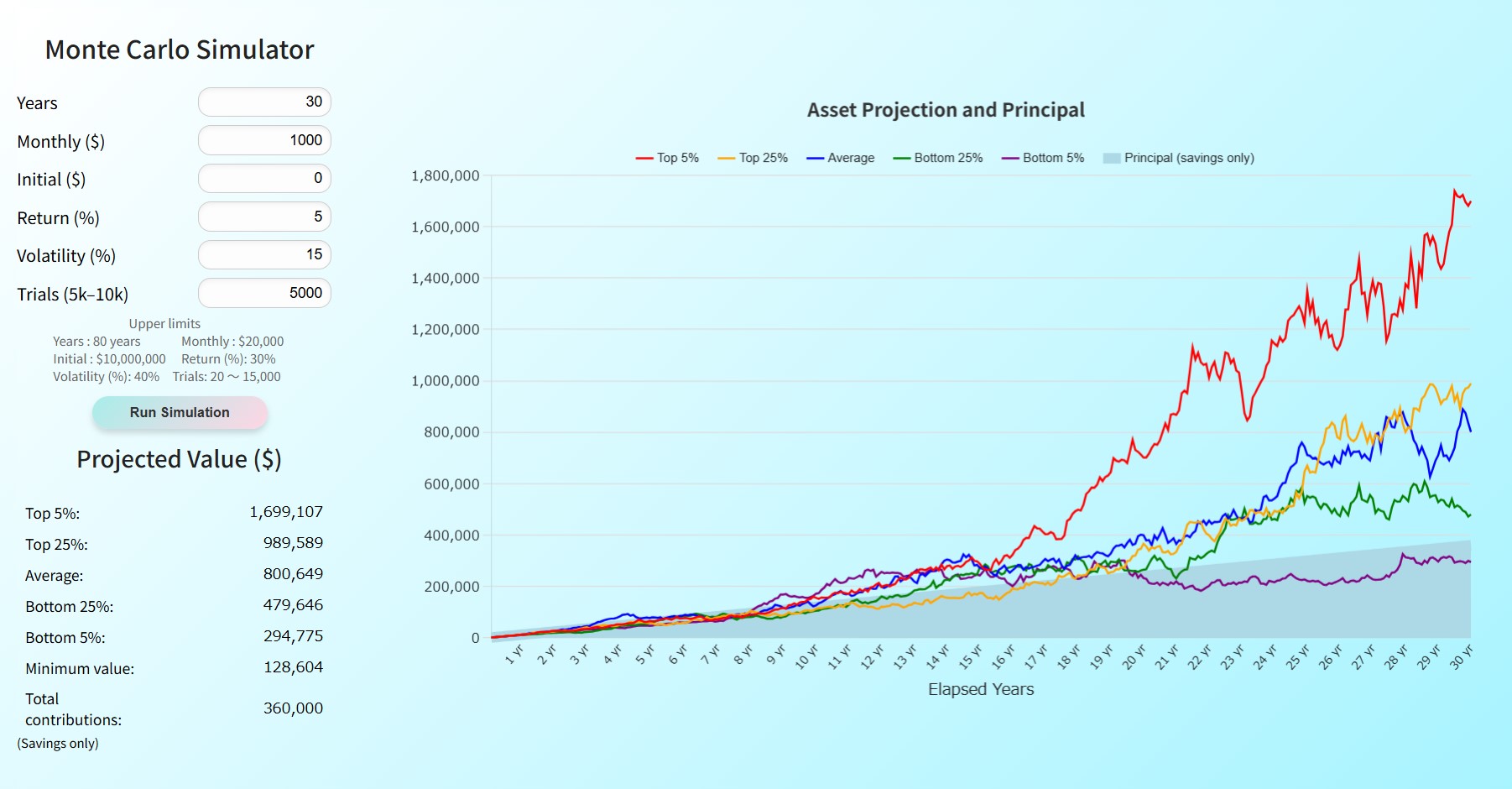

Monte Carlo simulation generates thousands of possible future scenarios by combining:

- Average returns,

- Year-to-year volatility,

- Random sequences of gains and losses.

Instead of a single average path, it produces a distribution of outcomes showing:

- Typical cases,

- Better-than-average cases,

- Worse-than-expected cases.

For retirement planning, it’s not the average that matters most—it’s how bad outcomes might plausibly be, how far assets might decline, and whether retirees can maintain their lifestyle in those scenarios.

What Retirement Planning Needs Most: Margin

The biggest flaw of average-return planning is that it tends to produce tight or borderline plans. Monte Carlo simulation naturally reveals:

- Worse cases than expected,

- Prolonged periods of poor performance.

This leads to an understanding that planning should include slack (margin), such as:

- Modest withdrawal rates,

- Holding some cash,

- Building flexibility into spending.

In retirement, margin is not waste—it’s a safety device to survive unpredictable futures.

Average Return Is a Reference, Not the Answer

While average return remains a useful long-term benchmark, treating it as a guarantee or certainty makes retirement plans brittle. What retirees truly need is a plan that:

- Survives even when results aren’t average,

- Doesn’t force disruptive behavior changes when things go differently than expected.

Average return can be a starting point—but real planning requires paying attention to the range of possible outcomes and the margin for safety.

Rethinking Retirement Planning

If you plan based only on average returns, you may:

- Overlook sequence of returns risk,

- Suffer psychological stress when reality deviates,

- End up with plans that are too tight.

Monte Carlo simulation shows the range of plausible outcomes, not just the average. Retirement planning isn’t about elegant numbers—it’s about building a design that endures real-world uncertainty. Focusing on distributions and margin is the key to avoiding retirement planning failure.